Hundstad part two

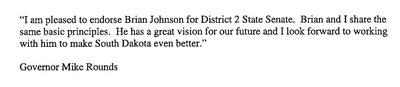

I just got this tonight, as issued from the Rounds for Governor campaign. It was issued in response to the Hundstad for Senate campaign's "less than honest" advertisement of Hundstad being pictured with Governor Rounds in a "National Enquirer" style photo.

I just got this tonight, as issued from the Rounds for Governor campaign. It was issued in response to the Hundstad for Senate campaign's "less than honest" advertisement of Hundstad being pictured with Governor Rounds in a "National Enquirer" style photo.I hate to say.... Okay, no I don't.

I told you so.

Hundstad dug his own grave on this one. He involuntarily drug Governor Rounds into this race. But now, Brian Johnson gets to reap the benefit. Because he's going to have the Governor's full support and backing while Hundstad is left responding to embarassing questions about his intent and honesty.

Stupid.

Comments

Fun, ain't it? And uplifting, too. God bless America.

So he's trying to turn a photo-op that everyone in the room, including the photographer, knew would probably be used in a campaign ad, into some sort of sinister scandel.

Now we have a "this just in" endorsment for Jim Hunsteads opponent from the gov., intent on setting the record straight. hahaha.

No, I checked on Brian. He's a green horn, just out of college. No experience. He served as an intern. And not a good one at that. A snotnosed kid needs to get out in the world and learn a little before he serves in the South Dakota Senate.

Compared to a seasoned, veteran Senator? No, Brian is an "untested" candidate. It would be "too risky" to put him in the senate.

This is unforgivable. To Jim Hundstad, the National Guard and Reserves are pawns in his re-election bid. To suggest anything else is dishonest. If you disagree, consider what HB 1085 (2004) actually accomplished and what he implied it did.

It affected only the disabled.

He implied it affected all.

IT DISCOUNTED PHEASANT OR FISHING LICENSES!

He said it "insures our S.D. Guard and Reservists receive treatment equal to regular armed service personnel."

Of course, people in Doland probably wouldn't rally around an ad that said, "A couple people can save a buck or two on their hunting licenses because of what I managed to do."

Oh, and never mind the fact that "his" bill was killed in committee the first time it was heard. According to the state website, the bill died, and was subsequently revived and amended extensively before finally passing.

It is particularly fitting that Jim Hundstad would have introduced such a bill. He's really hunting for a platform as he fishes for votes.

Hundstand is ineffective. I can't believe anyone would want him to represent them for anything.

Brian Johnson doesn't stand a chance. We all know what he's going to run on. And people are sick and tired of it.

Rounds' vision:

5 of the 10 poorest counties in the NATION

80% of school districts forced to opt out and raise property taxes even when our Education Enhancement trust fund has grown from $339 million in 2003 to $370 million in 2006. Rounds stockpiled money for the purpose of forcing property taxes higher. Note to Rounds: We don't need higher taxes - government has the money already!!!

Higher taxes, bigger government (800 new state employees)

"Sick tax" that Rounds sponsored as a senator to tax people who use the hospital. Kick-em while they're down. If the hospital doesn't get their money the state will. Rounds is sick!

Trying to take away federal constitutional rights

New governor's mansion, new governor's airplane, vodka distillery for Rounds' brothers, exclusive no-bid license for Rounds's brother to sell merchandise at Vietnam Veteran's memorial event.

We can't afford 4 more years of Rounds' "vision" and we can't afford candidates who promise to rubber-stamp Rounds' policies.

As much as I love PP and his Republican ideas, PP's outrage is a little misplaced. If PP wants to be angry at anyone, point the finger at his boss.

Only a fool would believe that picture would not be used as a campaign tool. Rounds let himself be used, and if he would have had any political snap at all, Rounds would have lined up a dozen Republicans to be in the same picture with Sen. Hundstad. Therefore, diluting the political fall out. Didn't happen, too late.

If we must discuss Hundstad's ability to get legislation passed, let's talk about this.

Republican controled legislature: I have seen instances of good Democratic legislation that was killed and later reintroduced with Republican sponsors. I have seen good legislation killed because there were no Republican sponsors, just Democrats. We are a partisan legislature, but good legislation should be passed regardless of the parties. I despise this game playing, but both sides are guilty of this practice. I'm not pointing the finger at anyone, this is just politics.

Hundstad has as much chance of getting something passed as the rest of the minority.

And yes, even Senator Kloucek has come up with some good legislation.

Even that one guy, what's his name? Adel-something, had a couple good ideas.

Brian Johnson made a mistake attacking Amendment D. Regardless of how you feel about D, there are many Republican legislators supporting D.

Did Johnson now lose their support? I hope not, Brian is a good kid.

I don't know anything about Brian Johnson other than he is young. I think it's really sad that people on here assail peoples' character with out knowing one thing about them.

12:11 probably doesn't have a clue about Amendment D or our property tax system; they just regurgitate the rhetoric. How many times have we passed referendums and during the campaign have to be told about the laundry list of fixes that need to be made in session to even make it work? Hundstead came and talked to our regional county officials that included the assessors. I actually felt bad for him because he was so embarrassed by his lack of understanding of the technical points of Amendmend D. All Napoli can do is retort back that it will be fixed with legislation.

I don't care as much about the taxes as I do that it is very discriminatory against young people trying to start out. Anybody want to challenge that fact?

Does anyone wonder what the future holds for South Dakota agriculture?

Kidding! I think....

There you go again! No one should bitch about Rounds being in a picture with a Democrat, when Rounds is willing to participate. Frankly I don't care who Rounds takes pictures with. Rounds is pretty though, isn't he?

Our present property tax system discriminates against anyone who's only desire is to live out their lives in their homes, ranches, or have a business in this state, and not lose their property because the child bought the place next door for more money.

Challenge you 1:57? Damn Right. Your statement about the young is facetious at best. Makes a really good sound bite, doesn't it?

What's the difference between a young buyer, or an old buyer, a middle aged buyer? How about a black buyer or a white buyer?

All you are doing is looking for a sympathy vote using the phrase (young buyers) instead of the truth.

Amendment D doesn't discriminate against anyone. Under our present system we have no control over our property taxes. Every time someone buys in our neighborhoods, everyone's taxes go up. Under Amendment D, only the new buyers taxes may go up, then again they may not. But, it is their choice to buy that property, then they will know what their taxes will be. All new buyers will be protected by Amendment D with an assessment growth of no more than 3%.

You are right Anonymous, I can tell you don't care about taxes, or that people are being taxed off their farms and ranches, the elderly lose their homes, businesses struggling to pay 20-30-40% increases in taxes.

Yep! You don't care about taxes, but I do.

If you want lower property taxes, why not lower property taxes?

I'm all ears, pal. You have a potential vote here, if you can persuade me. Honestly.

My son moved into South Dakota from Iowa. He pays less property tax, and since both he and his wife work in state, they don't have to pay state income tax. He's happy with the situation - just not with the politics here. I guess you can't everything the way you want it.

You of all people understand how to get the sympathy vote. Amendment D so innocently asks if you would like your property taxes to stop going up so much. I am not at all saying that property taxes are not a problem and I will certainly give you an A for effort but this is simply asking the people to choose the lesser of two evils.

In most communities, there is a certain price range that accommodates first time home buyers. And making the presumption that valuations go up like they have been, every time that house gets sold it gets a new stepped up basis. All of the sudden who cares about the nice yard, wood floors, and new cabinets, the property tax differention makes two homes that are exactly the same value worth a lot more or less because one person stayed there 20 years and the other house was sold 5 times. House A is worth 150,000 and the property taxes are $2200/ year. House B is also worth 150,000 but has been sold 5 times in 20 years and the taxes are $5500/year so that has a negative effect on the value.

Let's go to the business side.

Jonnies hardware store has been in business for 20 years and his property taxes only went up 3% every year. Susy thinks the town needs another hardware store so she buys a nice building close to Jonnies for fair market value. Both buildings are worth about the same but Susy's building just got a new tax basis which is 5 times what Jonnie's is. Should the tax system say the hell with Suzy because she should know those costs going in or should our tax system treat Jonnie and Suzy equal.

The bottom line is the established business owner will always have a leg up on new competition.

http://www.state.sd.us/drr2/propspectax/booklets/tax_collected2003.pdf

Even when the taxes go unpaid, it takes a few years for anyone to get a tax deed to the property. Does anyone know who would track the number of people that actually lose their property because of taxes? Can't find anything on the state's website.

Also, there are relief programs that can reduce property taxes for the elderly or disabled. Why is this insufficient? It looks to me like someone eligible for the "Assessment Freeze for the Elderly and Disabled" would get a better deal than they would under Amendment D.

http://www.state.sd.us/drr2/propspectax/property/relief.htm

absolutely not true,,,,,,,Guess again. You are just one of thousands of folks talking about property taxes that dont understand the current system enough to comment on it let alone amendment D.

local effort (property taxes) for the general fund for k-12 has decreased by almost 6 million dollars,,,,my taxes went up big !!

tell us what school district you are from and I bet I can tell why you oppose D !!

City and County money stay in the City and County, The schools general fund levy has no bearing on local spending,,,wanna bet ?

Congratulations, you got that right. The State sets the general fund levy for K-12. Which means, because of varying increases in assessments, the total taxes collected could go down, while actually raising taxes for some. And the folks that had the increase in taxes, did not have to be in a school district that was increasing expenditures, taxes increase because of INCREASING ASSESSMENTS, and not because of increasing spending. Spending has been capped, but taxes collected from an individual tax-payer have not been capped.

If assessments go up, boards that are prudent spenders can lower the levy to offset the increased assessments.

Does South Dakota have a limit on the levy amount?

How many chose less ?, haha

you have got to be kidding,

177 or so school districts, over 100 opt out attempts and you defend the current system by saying you can tax less ????

You are obviously a legislator, isnt it a bit of hypocrisy to put the cities, counties and schools at 3% or the rate of inflation while your budget grows double digit every year ?

If your sytem is so great put the Regents on it, OK ? put Social Services on it, ok, ? and hey how about Corrections ? how about a flat 3% or rate of inflation per prisoner ?

You could choose to spend less as a legislator, also, couldnt you ?

What do you as a legislator care about D anyways, all your money comes from sales tax, The State really doesnt have a dog in this fight.

Fun, ain't it? And uplifting, too. God bless America.